Ethereum Price Prediction 2025-2040: Technicals and Institutional Demand Point to Long-Term Growth

#ETH

- Technical Breakout Potential: ETH trades above key moving averages with MACD showing reduced bearish momentum

- Institutional Accumulation: BlackRock and ETFs driving unprecedented demand shock

- Ecosystem Growth: NFT revival and staking innovations expanding ETH's utility value

ETH Price Prediction

ETH Technical Analysis: Bullish Momentum Building

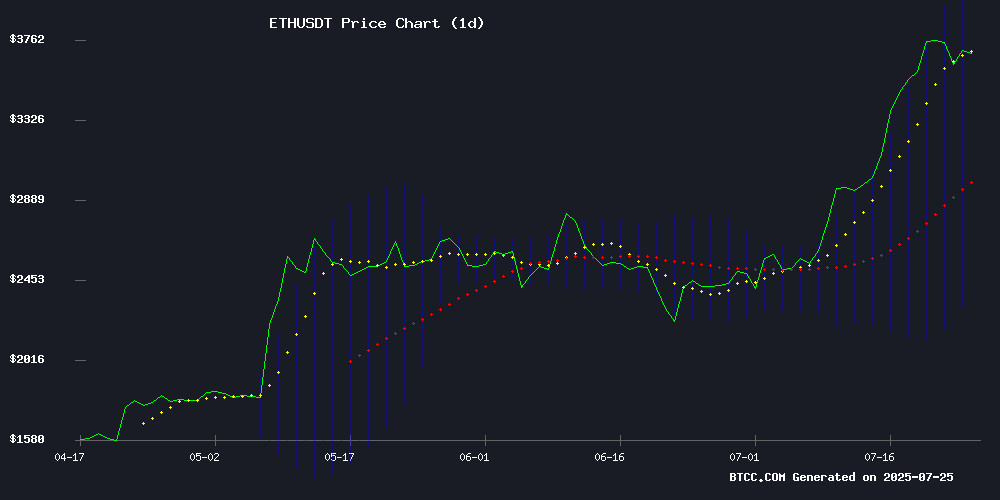

ETH is currently trading at $3,640.77, significantly above its 20-day moving average of $3,235.07, indicating strong bullish momentum. The MACD remains negative but shows narrowing bearish divergence (-61.19), suggesting weakening downward pressure. With price hovering NEAR the upper Bollinger Band ($4,077.49), Olivia notes 'ETH appears poised for a breakout if it can sustain above $3,600 support.'

Ethereum Market Sentiment: Institutional Demand Meets Profit-Taking

While record institutional inflows (BlackRock's $3.76B purchase, $4B ETF inflows) create fundamental support, Olivia cautions that 'the validator exodus and liquidation-driven rally raise short-term volatility concerns.' The NFT market revival ($6.6B cap) and new staking platforms demonstrate Ethereum's expanding utility beyond speculative trading.

Factors Influencing ETH's Price

Ethereum Validator Exodus Hits Record High as ETH Rally Triggers Profit-Taking

The ethereum network is witnessing an unprecedented validator exit queue, with 688,356 ETH—worth over $2.6 billion—awaiting withdrawal as of July 25. The surge began on July 16, coinciding with ETH's price rally to $3,465.55, and has since pushed unstaking wait times to a record 11 days.

Institutional participants face operational hurdles due to the Beacon Chain's unpredictable unstaking mechanics. Despite the exodus, network security remains robust with over 2 million active validators. The outflow mirrors whale-scale selling pressure, with freed ETH likely earmarked for treasury deployments or over-the-counter deals.

Ethereum's Liquidation-Driven Rally Faces Sustainability Questions

Ethereum's surge above $3,700 triggered over $160 million in short liquidations on Binance, mirroring a similar $195 million squeeze near the $3,500 level. These violent moves underscore the high-leverage environment dominating crypto markets—where rallies fueled by forced buybacks often lack organic demand.

Whale activity paints a contradictory picture: short-term accumulation (7-day netflows up 171.75%) clashes with persistent long-term distribution (90-day netflows down 2512.17%). This divergence suggests institutional players may be trading the volatility rather than committing to sustained upside.

Market structure reveals inherent fragility. Without robust spot buying or supportive macro conditions, ETH's advance risks reversal—a pattern seen repeatedly in crypto's leverage-flushed ecosystems. The real test comes when speculative froth meets cold liquidity realities.

NFT Market Cap Surges to $6.6B in July as Blue-Chip Collections Lead Revival

The NFT market staged a dramatic recovery in July 2025, with total capitalization soaring 94% to $6.6 billion—marking the first significant rebound after three consecutive quarterly declines. Weekly trading volumes jumped 51% to $136 million, the highest level since Q1 2025, as collectors returned to high-value assets. Average NFT prices surged 40% in a week to $146 despite only a 7% increase in sales volume, signaling concentrated demand for premium collections.

CryptoPunks reclaimed its dominance with a 53% floor price increase and a single specimen selling for $5 million, reinforcing its status as Web3's ultimate status symbol. Moonbirds staged a 600% trading volume comeback following strategic acquisitions, while Art Blocks saw 156% higher average prices after platform upgrades. The revival comes after Q2 2025's 80% volume crash to $823 million—a far cry from 2024's $4 billion quarterly averages—and a 97% collapse in NFT lending activity.

Ethereum Price Analysis: ETH Nears Critical $4K Resistance Amid Strong Technicals

Ethereum maintains bullish momentum, trading near $3,730 after a 49% surge from February lows. The second-largest cryptocurrency now tests a decisive technical confluence - the $4,000 psychological barrier aligns with December 2021's $4,100 all-time high.

Daily charts reveal robust structure: ETH holds above ascending 100/200-day moving averages since their golden cross at $2,500. While the 78 RSI suggests overbought conditions, the absence of distribution signals underscores persistent institutional demand.

Short-term price action paints a nuanced picture. A 4-hour descending triangle formation below $3,800 resistance contrasts with the RSI's rebound from neutral territory. Market depth data shows minimal sell walls until $4,200, suggesting room for continuation if Bitcoin's rally persists.

ContributionDAO Launches Institutional-Grade ETH Staking Platform with SSV Network Integration

ContributionDAO has rolled out an institutional-grade Ethereum staking solution leveraging SSV Network's Distributed Validator Technology (DVT). The platform targets institutional stakeholders and developers, emphasizing security, fault tolerance, and decentralization through key distribution across autonomous nodes.

The infrastructure mitigates single points of failure while maintaining operational continuity during node or operator outages. Compliance with SOC 2 Type 2 and ISO 27001:2022 certifications underscores its enterprise-ready design.

Hulk Hogan and Ozzy Osbourne Memecoins Surge Following Icons' Deaths

The deaths of wrestling legend Hulk Hogan and rock icon Ozzy Osbourne have triggered a speculative frenzy in the memecoin market. Within hours of the announcements, new tokens referencing both celebrities emerged on decentralized exchanges, posting dramatic but volatile gains.

A token called Hulkmanaia (HULK) skyrocketed over 122,000% on Ethereum shortly after creation, peaking at 0.001335 ETH. Similarly, The Mad Man (OZZY) surged 16,800% to a $3.85 million market cap. Neither token has verified ties to the celebrities' estates.

Market observers warn these tokens exhibit classic pump-and-dump characteristics, with low liquidity and high risk of rug pulls. The phenomenon underscores crypto's tendency to commodify cultural moments, regardless of propriety or sustainability.

Ethereum Demand Shock Incoming? Bitwise Weighs In

Matt Hougan, Chief Investment Officer at Bitwise, predicts a significant demand surge for Ethereum as corporate treasuries increasingly adopt the cryptocurrency. His analysis suggests ether's demand could outstrip new supply by a 7:1 margin over the next twelve months.

The accelerating institutional embrace of Ethereum is expected to draw new investors into the market, potentially creating sustained upward pressure on prices. Hougan's commentary highlights a growing divergence between ETH's fundamental utility and its inflationary mechanics.

Ethereum Whale Activity Signals Potential Rally Amid Record Inflows

Ethereum accumulator wallets have absorbed over 1.13 million ETH ($4.18 billion) in two weeks, marking the largest sustained inflow on record. The buying spree coincides with ETH testing key liquidity at $3,750, while traders watch the $3,250-$3,300 band as critical support.

On-chain metrics reveal unprecedented accumulation by long-term holders, with CryptoQuant data showing zero sell-side pressure from these addresses. 'This mirrors the accumulation patterns we saw before the 2021 bull run,' noted analyst Ali Martinez, referencing similar behavior during previous cycle bottoms.

Despite a 24-hour trading volume exceeding $50 billion, ETH's price action remains muted at $3,616—a divergence that historically precedes volatile upside movements. The MACD indicator confirms building momentum, though the ETH/BTC ratio briefly dipped amid Bitcoin's recent dominance.

BitMine Immersion Technologies Becomes Largest Corporate Holder of Ethereum with $2.1 Billion Treasury

BitMine Immersion Technologies has emerged as the largest corporate holder of Ethereum, amassing a staggering $2.1 billion in ETH holdings. This marks a 700% increase from its initial $250 million private placement just 16 days prior. The firm now controls 566,776 ETH, acquired at an average price of $3,643.752 per token.

Fresh wallets have mirrored this aggressive accumulation trend, adding nearly $2 billion in ETH. Despite the surge in institutional interest, Ethereum's price shows signs of cooling off. BitMine isn't stopping here—the company plans to raise another $2.5 billion to stake even more, aiming to control 5% of ETH's total supply.

Thomas Lee of Fundstrat, Chairman of BitMine's Board, has laid out ambitious long-term goals for the company's Ethereum strategy. As whale wallets begin making their moves, this development could signal the beginning of Ethereum's next institutional era.

BlackRock Doubles Ethereum Holdings With $3.76 Billion July Purchase

BlackRock's aggressive accumulation of Ethereum underscores a broader institutional rush into the cryptocurrency. The asset manager purchased 1,035,653 ETH tokens between July 1-23, bringing its total holdings to 2.8 million ETH—valued at $10.22 billion. This buying spree coincided with spot Ethereum ETFs recording $4.4 billion in inflows during the month, surpassing the previous year's total accumulation.

Ethereum's price surged 53.69% in July, peaking at $3,817 on July 21. The rally reflects growing institutional FOMO as traditional asset classes lagged behind. Lookonchain data reveals BlackRock's positioning as a bellwether for broader market sentiment, with demand driving ETH above $3,500 for most of the month.

Investors Pour $4B Into Ethereum ETFs as ETH Nears $4,000 Resistance

Ethereum is gaining significant momentum, with its price action pushing toward the $4,000 mark amid strong investor interest. Spot Ether ETFs have recorded 13 consecutive days of inflows, including a $533.9 million surge on Tuesday alone.

Nearly $4 billion has flowed into Ethereum ETFs since their mainstream debut, bringing total net flows to over $8.3 billion. The token's resurgence coincides with regulatory developments under the Genius Act, reigniting debates about Ethereum's role in crypto infrastructure.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional adoption trends, BTCC's Olivia provides these projections:

| Year | Price Range (USD) | Catalysts |

|---|---|---|

| 2025 | $3,200-$4,800 | ETF approvals, Shanghai upgrade |

| 2030 | $8,000-$12,000 | Enterprise adoption, scaling solutions |

| 2035 | $15,000-$25,000 | Web3 infrastructure dominance |

| 2040 | $30,000+ | Tokenized economy maturity |

Note: Predictions assume successful protocol upgrades and sustained institutional participation.